Message from the President

-

Representative Director

and President Satoshi Arata

Launching Medium-Term Management Plan "PROGRESSIVE PLUS 2027"

Establishing a lean, sustainable, and highly profitable earnings model

Helping solve social issues through our businesses, centering on Environmental Creation Technology

ESPEC's mission is to “provide more dependable living environments through our business activities, centering on Environmental Creation Technology.” The core of our business is our Environmental Creation Technology, which reproduces the diverse natural environments found on Earth. By delivering products and services that leverage this technology to customers worldwide, we aim to help build a richer, safer, and more secure society. This is our purpose and the unchanging value that defines who we are.

In recent years, climate change has become increasingly severe, with global average temperatures repeatedly hitting record highs.

Geopolitical risks, population issues, and resource challenges are also mounting across the globe. At the same time, development of advanced technologies such as AI semiconductors, autonomous driving services, and satellite communications continues to accelerate. There is widespread hope that these technologies can play crucial roles in addressing many of today's social challenges. Guided by our founding spirit of being “Progressive,” we will contribute to solving social issues and enhancing corporate value by providing essential products and services that support the practical application, safety, and reliability of cutting-edge technologies.

Early Achievement of "PROGRESSIVE PLAN 2025" the Previous Medium-Term Management Plan

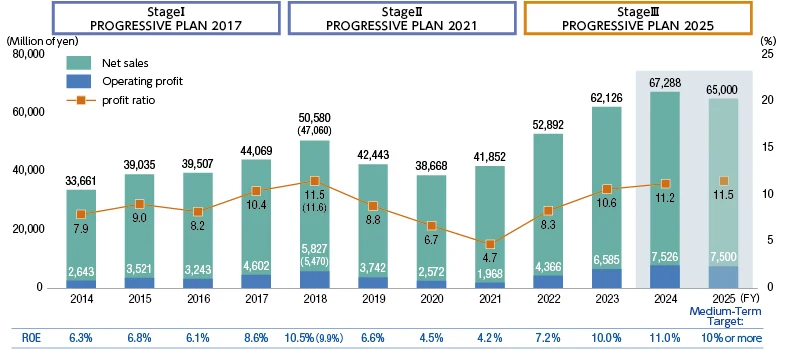

Under the previous Medium-Term Management Plan, "PROGRESSIVE PLAN 2025" (Implementation period: FY2022-FY2025), we set medium-term targets of 65.0 billion yen in net sales, 7.5 billion yen in operating profit, an operating profit ratio of 11.5%, and ROE of 10% or more in FY2025. Amid the growing demand in the EV and battery sectors driven by digitalization and decarbonization, we accurately grasped customer testing needs, responded to components procurement difficulties, adjusted product and service pricing, and strengthened production capacity. As a result, we achieved record-high results in FY2024: net sales of 67.2 billion yen, operating profit of 7.5 billion yen, an operating profit ratio of 11.2%, and ROE of 11.0%, thereby achieving the plan’s targets one year ahead of schedule.

While the previous plan brought significant growth and many achievements, several challenges remain, particularly those related to improving quality for sustainable growth, such as enhancing added value, increasing manufacturing efficiency, and strengthening human capital. Although we reached record performance levels, our efforts toward improving quality proved insufficient. In the new Medium-Term Management Plan starting in FY2025, we place particular emphasis on initiatives to drive quality improvement.

■ "PROGRESSIVE PLAN 2025" Targets & Results

* FY2018 was an irregular 15-month fiscal period for overseas consolidated subsidiaries.

"()" figures showing values based on a 12-month accounting period.

Formulation of New Medium-Term Management Plan "PROGRESSIVE PLUS 2027"

Our Operating Environment on the Path to FY2027

Our SWOT analysis of the operating environment facing us as we approach FY2027 was very enlightening. Internally, our strengths lie in our brand leadership and top market share within the environmental test chambers industry, as well as our long-standing relationships and trust with global companies. We also recognize our extensive product lineup, designed to meet the needs of different customers, together with our customization capabilities and global network, as our competitive advantages. Our weaknesses include reduced operational efficiency due to rapid order expansion, challenges in product development aligned with advanced technology needs, and delays in passing on technical skills due to labor shortages. Externally, we forecast that development in advanced technology fields such as AI semiconductors, autonomous driving services, and satellite communications is accelerating, creating strong testing demand. The growing trend toward outsourcing testing operations, amid a declining workforce and more sophisticated testing requirements, also presents our new business opportunities. On the other hand, our concern is that we face risks such as the global economic slowdown partially driven by U.S.-China tensions, intensified price competition with Chinese and Taiwanese companies, and the potential slowdown of investment in EVs and batteries. Regarding the impact of U.S. reciprocal tariff policies, we believe that the direct effect on our business will be minimal, as we have a subsidiary in the United States with a high local production ratio and very little trade between the U.S. and China. We may experience the indirect impact of investment being restrained due to a global economic slowdown, but investment in advanced technology development is expected to continue. We will continue to closely monitor the situation and respond appropriately by leveraging our global capabilities.

Becoming a Lean Enterprise Through Quality Improvement and Profit Growth

Looking ahead to our long-term vision for 2035, ESPEC has formulated a new Medium-Term Management Plan, "PROGRESSIVE PLUS 2027" (Implementation period: FY2025-FY2027). Establishing a lean, sustainable, and highly profitable earnings model is our basic policy. Through FY2027, we will shift toward improving quality and transform into a leaner and stronger organization. By improving quality, we mean improving all internal capabilities, including ESPEC’s management capabilities, product strength, technical capabilities, manufacturing capabilities, customer proposal capabilities, and human resource capabilities. Our primary financial targets are as shown on the right, with particular focus on achieving an operating profit ratio of 15.0% and ROE of 12.0% or more. By setting these challenging goals at levels we have never achieved before, we will lay the groundwork for the next stage of sustainable growth through FY2027.

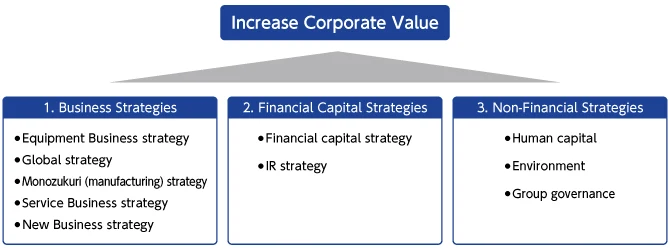

Under PROGRESSIVE PLUS 2027, we will execute aggressive growth investments and shareholder returns by advancing the three strategies to enhance corporate value: business strategy, financial capital strategy, and non-financial (ESG) strategy.

■ "PROGRESSIVE PLUS 2027" Basic Policy and Targets

Establishing a lean, sustainable,

and highly profitable earnings model

Aiming to continuously increase our value as a corporate group by becoming a "lean enterprise," which we will achieve through quality improvements and profit growth.

■ Target markets

AI semiconductors, autonomous driving, satellite communications

■ Medium-term target

FY2027

| Net sales | ¥70 billion |

| Operating profit | ¥10.5 billion |

| Operating profit ratio | 15.0% |

| Profit | ¥7.6 billion |

| ROE | 12.0% or more |

* Expected rate (U.S. dollars) ¥145

■ "PROGRESSIVE PLUS 2027" Three Strategies

Advancing business strategies in AI semiconductors, autonomous driving services, and satellite communications fields

Our target markets are AI semiconductors, autonomous driving services, and satellite communications. All areas where demand for testing is expected to expand as advanced technologies move toward practical application. These electronics markets, in which ESPEC already has an extensive track record, represent growth opportunities on par with the automotive sector. The value we offer in these advanced technology fields lies in ensuring quality, including high reliability and durability, for the practical application of advanced technologies. In the AI semiconductor and autonomous driving fields, our aim is to help solve technical challenges associated with the increased semiconductor integration and enhanced sensor performance required by autonomous driving. In the satellite communications field, we will support development efforts for commercial satellite communications in the U.S. and small satellite communications by private companies in Japan. AI semiconductors and satellite communications are a part of social infrastructure, and autonomous driving can impact human safety, as there is a growing need for various types of testing. We believe this will further expand our business opportunities. ESPEC’s business opportunities will continue to expand as we work to ensure safety, reliability, and peace of mind through our environmental testing business.

1.Business strategy

Creating New Value and Capturing Testing Demand in Advanced Technology Fields

To achieve our medium-term targets, the Equipment Business strategy focuses on capturing testing demand in target markets through a diverse product lineup, strong customization capabilities, and new product development in environmental test chambers, while maintaining a high level of sales. We will also expand R&D investment to acquire new testing opportunities, and will focus on expanding the product portfolio and enhancing product value.

In our global strategy, we position Japan, the U.S., and China as regions focused on improving profitability; India, South Korea, and ASEAN as regions aiming to expand sales; and Europe and Taiwan as regions targeting demand in advanced technology fields. We will leverage the collective strengths of the Group to establish competitive advantages in each area.

Our approach to manufacturing strategy is to promote labor-saving and automation at Kyoto Prefecture’s Fukuchiyama Plant by leveraging AI and IoT to enhance manufacturing efficiency. Specifically, by connecting all processes through digital technologies, we aim to optimize the value chain, shorten lead times by expanding in-house production, and transform the plant into a facility that maximizes human potential through DX-driven innovation.

In the Service Business strategy, in the laboratory testing services, we aim to expand profitability centering on the Aichi Next-Generation Mobility Test Lab, which was opened in February 2025. In the after-sales service, the trend toward outsourcing equipment maintenance is expected to strengthen due to the declining labor population. At the same time, customer needs shift from repair services to preventive maintenance services such as inspections, calibrations, and maintenance contracts. By utilizing IT and digital technologies, we will expand services such as remote monitoring of equipment and provide high-quality solutions that address customer challenges.

As part of our New Business strategy, we will foster new future revenue pillars through initiatives such as expanding thermal solution services related to CAE* and growing our food machinery business. In thermal solution services, through the provision of thermal-dependent warpage measurement systems, thermal image analysis systems, and contract measurement services, we aim to contribute to improving CAE accuracy and shortening customers’ development timelines.

* CAE (Computer Aided Engineering) refers to technologies that support product design and development using computers

■ Target Markets by Region

2.Financial Capital Strategy

Proactively allocating generated cash to growth investment and shareholder returns

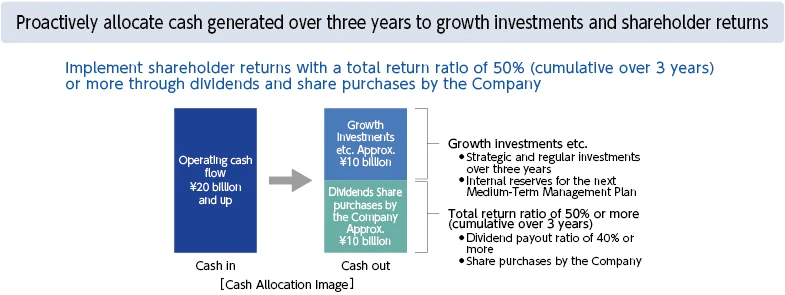

Our Financial Capital strategy is defined by pursuit of management that is conscious of capital cost and share price, while focusing on improving total asset efficiency, executing shareholder returns based on our cash allocation policy, and enhancing IR activities. We will generate cash by improving operating profit ratios through business strategies and optimizing total assets, including inventory control and reduction of trade receivables, and actively allocate it to growth investments and shareholder returns. We plan to invest approximately 9.5 billion yen, equivalent to the amount in the previous plan, primarily to enhance manufacturing efficiency through updates and renovations to the Fukuchiyama Plant’s production facilities, strengthen global bases, and renew core systems. R&D expenses will increase approximately 1.3 times (from 3.6 billion yen to 4.8 billion yen), while education investments will grow about 1.2 times (from 360 million yen to 430 million yen).

To clarify our strengthened commitment to shareholder returns, we have revised our basic policy on dividends in the formulation of the medium-term management plan and renamed it the Shareholder Return Policy. We raised our dividend payout ratio from the conventional 30% to 40% and will flexibly conduct acquisitions of treasury shares. During the "PROGRESSIVE PLUS 2027" period, we are targeting a cumulative total return ratio of 50% or more over three years, with no dividend reduction. We will also enhance IR activities by deepening dialogue with shareholders and investors to further improve market valuation and management quality.

- Related Pages:

■ Cash Allocation Policy

3.Non-financial Strategies(ESG)

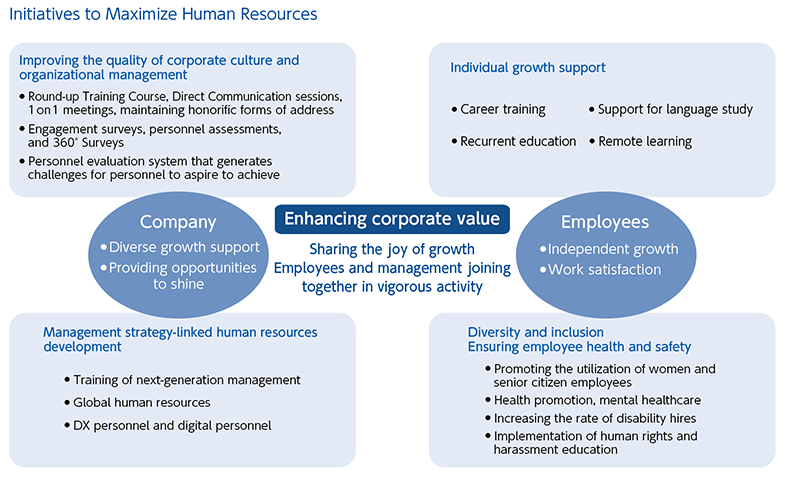

Promoting Initiatives to Maximize Human Resources

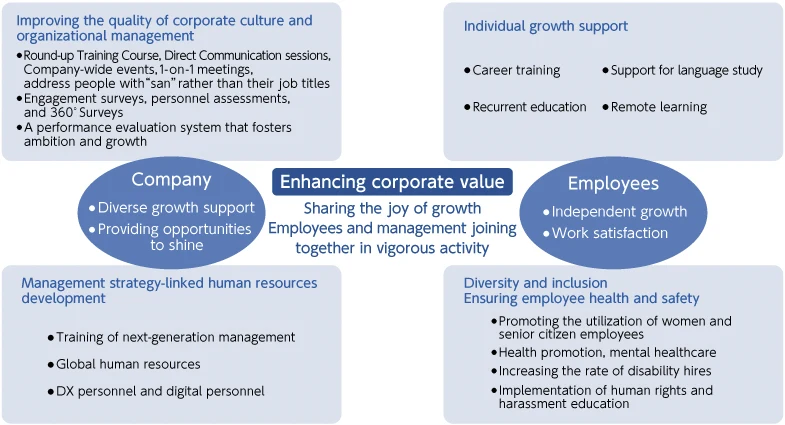

Enhancing corporate value requires not only financial initiatives but also non-financial efforts focused on ESG. We place particular importance on human capital, as people are the foundation of our company and the driving force behind our growth. Initiatives to maximize human resources are shown in the diagram below. Under PROGRESSIVE PLUS 2027, we will especially strengthen initiatives for both talent acquisition and development, foster open communication, create fulfilling workplaces, and raise employee engagement to build a strong organizational foundation. We also continue to advance diversity and inclusion. As of April 2025, women accounted for 9.8% of management positions, nearly achieving our previous plan’s 10% target. In the new plan, we have set an FY2027 target of 20% or more. We will continue to aim to be a vigorous organization where a variety of people can thrive.In our efforts for the environment, we are pursuing initiatives focused on climate change mitigation and biodiversity conservation. In FY2024, we launched the Platinous J Series Temperature (& Humidity) Chambers, a global standard model of environmental test chambers that reduces power consumption by up to 70%. Additionally, our Kobe R&D Center received the Director-General's Award of a Regional Bureau of Economy, Trade and Industry for Greenery Factory, a source of great pride for us. Looking ahead, we plan to formulate the 8th Medium-Term Plan on the Environment Plus II for FY2026–FY2027 to further accelerate environmental initiatives. In governance, we will strengthen Group governance and risk management, while also implementing initiatives such as formulating a human rights policy and promoting harassment prevention.

■ Initiatives to Maximize Human Resources

The strategies and initiatives laid out in "PROGRESSIVE PLUS 2027" all have the ultimate aim of transforming ESPEC into a lean, sustainable, and highly profitable enterprise that will continue to be a global leader in environmental testing for the decade ahead. We sincerely ask for your continued understanding and support.

October, 2025

Representative Director and President Satoshi Arata

Latest Materials

-

Download

All DataZIP 5.74MB

-

Preliminary Results

(FY2025 3Q) -

Presentation Materials

(FY2025 2Q) Presentation Materials Reference

- Fact Book 2025

- ESG Data 2025