Fair and Transparent Management

Corporate Governance

Basic Stance

The Company firmly believes that a corporation is a public institution, or a social apparatus with roles and functions for fulfilling people's wishes and living up to the expectations of society. Based on this philosophy, the Company aims to become a highly efficient corporate medium for exchanging value. Accordingly, the Company shall provide all stakeholders with higher value through the mutually beneficial relationships it builds with shareholders, customers, business partners, employees and all other stakeholders it interacts with in the course of conducting its corporate business activities. By continually enhancing corporate governance with this philosophy as an impetus, the Company shall realize sustainable growth and enhance corporate value over the medium to long term, while fulfilling its social responsibility to stakeholders.

The Company has formulated and announced its Basic Policy on Corporate Governance, which outlines the basic stance of our Corporate Governance Code, and the policies for implementing each principle.

Corporate Governance Report

ESPEC has submitted a Corporate Governance Report, in which our corporate governance status is described, to the Tokyo Stock Exchange.

Corporate Governance Structure

Seeking to enhance deliberations in the Board of Directors meetings and further strengthen the Board of Directors’ supervisory functions, the Company has transitioned to a Company with Audit & Supervisory Committee by resolution of the 69th Ordinary General Meeting of Shareholders held on June 2022. In addition to the Board of Directors, we have established the Executive Officers' Meeting, composed of executive officers responsible for each business area, to expedite management decision-making and business execution. The Executive Officers Meeting makes decisions on matters delegated by the Board and discusses and examines concrete measures to implement resolutions made by the Board. Full-time Audit & Supervisory Committee Members attend important meetings, such as the Executive Officers' Meeting, to strengthen the audit function. We have also established a voluntary Nomination and Compensation Committee to deliberate on officer appointments and remuneration.

A schematic diagram of the timely disclosure system is shown below.

●Board of Directors

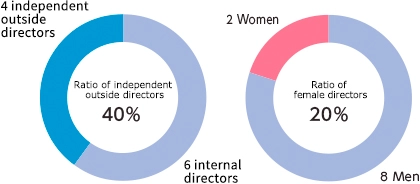

As of June 2025, the ESPEC Board of Directors is composed of ten members including four outside directors. In general, the board meets once each month, and discusses and decides the matters prescribed by laws and in the Articles of Incorporation, as well as business strategies, business plans, and other important matters related to management. It also performs supervision related to the execution of director duties. In order to make management responsibilities clear, the term of office for directors (excluding directors who are members of the Audit & Supervisory Committee) is one year. The four outside directors have been designated as independent directors, as required by the Tokyo Stock Exchange.

■Composition of directors (including directors who are members of the Audit & Supervisory Committee)

■Main Agenda Items of the Board of Directors (FY2024)

- Resolution of the Medium-Term Management Plan (FY2025 -FY2027) and the FY2025 Management Plan

- Discussion of management mindful of capital cost and share price, and resolution of related disclosure items for implementation

- Report on the operation based on the basic policy for preparation of an internal control system

- Discussion of methods for assessing the effectiveness of the Board of Directors and report on evaluation results

- Report on the Multi-Stakeholder Policy

- Progress report on the opening of the Aichi Next-Generation Mobility Test Lab (Tokoname Site), etc.

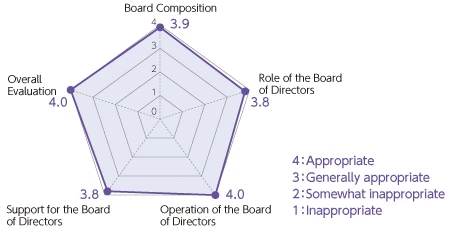

●Assessing the Effectiveness of the Board of Directors

Assessments are carried out to evaluate the effectiveness of the Board of Directors. In FY 2023, a survey-type self-assessment was carried out concerning the Board of Directors composition, roles, operation, and support. Interviews were conducted based on the responses, and were evaluated at a Board of Directors meeting in April 2024.

As a result, it was judged that the effectiveness of the Board of Directors as a whole has been secured based on the confirmation that the Board had put in place an organization for fulfilling its function of supervising management, and that conditions within the Board contributed to discussions and exchanges of opinions in a free, uninhibited and constructive manner. Meanwhile, the Board of Directors confirmed the need to take steps to further strengthen management and control of affiliated companies, as issues that must be addressed going forward. Looking ahead, we will continue to have discussions from various perspectives and endeavor to further improve the Board’s effectiveness.

■Category-based assessment results

●Audit & Supervisory Committee

As of June 20, 2025, the ESPEC Audit & Supervisory Committee is composed of three members, including two outside directors. In general it holds regular meetings once a month. It decides the audit policy and audit plan at the start of the year. Based on this policy and plan, the directors who are Audit & Supervisory Committee members conduct audits related to the execution of director duties (excluding directors who are members of the Audit & Supervisory Committee), the internal control system, calculation documents, and other matters.

●Nomination and Compensation Committee

The Company has established the “Nomination and Compensation Committee,” a voluntary body that deliberates on director appointments and compensation. From a standpoint of ensuring management transparency and objectivity, majority of the members of the Nomination and Compensation Committee are outside directors, and the chairperson and members are decided by the Board of Directors.

The Nomination and Compensation Committee met twice in FY2024, with all members in attendance. At the Board of Directors meeting held in June 2025, changes to committee membership were resolved. As of the end of June 2025, the committee members are: Representative Director and President, Satoshi Arata; Director and Managing Executive Officer, Kazuhiro Suehisa; Outside Directors Akihiko Yanagitani and Kazuo Hirata; and Outside Director and Audit & Supervisory Committee Member, Takahiro Tanaka. The committee is chaired by Outside Director Akihiko Yanagitani.

Management Team

●Our Directors (As of June 30, 2025)

Director

-

Representative Director and President Satoshi Arata

-

Director and Managing Executive Officer Kazuhiro Suehisa

-

Director and Executive Officer Junko Nishitani

-

Director and Executive Officer Hideyuki Oda

-

Director and Executive Officer Toshihiko Yoshino

-

Outside Director Akihiko Yanagitani

-

Outside Director Kazuo Hirata

-

Director (Standing Audit & Supervisory Committee member) Kunikazu Ishii

-

Outside Director (Audit & Supervisory Committee member) Takahiro Tanaka

-

Outside Director (Audit & Supervisory Committee member) Yasuko Yoshida

Executive Officer

- Kenji Fuchita

- Takehiko Umehara

- Norihiro Kajiguchi

■The skill matrix of Directors (As of June 30, 2025)

Please scroll horizontally to look at table below.

| Name | Position in the Company |

Outside | Experience and expertise | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Experience and expertise | International experience | ESG | Technology development and manufacturing | Sales and marketing | Human resource labor and development | Finance and accounting | Legal affairs | |||

| Satoshi Arata (Born in Oct. 1966) |

Representative Director and President | ● | ● | ● | ||||||

| Kazuhiro Suehisa (Born in Nov. 1963) |

Director and Managing Executive Officer |

● | ● | ● | ||||||

| Junko Nishitani (Born in Aug. 1959) |

Director and Executive Officer | ● | ● | ● | ||||||

| Hideyuki Oda (Born in Oct. 1974) |

Director and Executive Officer | ● | ● | ● | ● | ● | ||||

| Toshihiko Yoshino (Born in Mar. 1976) |

Director and Executive Officer | ● | ● | ● | ● | |||||

| Akihiko Yanagitani (Born in June 1955) |

Director | ● | ● | ● | ||||||

| Kazuo Hirata (Born in Dec. 1946) |

Director | ● | ● | ● | ● | |||||

| Kunikazu Ishii (Born in May 1958) |

Director (Standing Audit & Supervisory Committee member) |

● | ● | |||||||

| Takahiro Tanaka (Born in Jan. 1973) |

Director (Audit & Supervisory Committee member) |

● | ● | |||||||

| Yasuko Yoshida (Born in Nov. 1976) |

Director (Audit & Supervisory Committee member) |

● | ● | |||||||

Note: The above list does not cover all of the knowledge and experience of the directors

■Reasons for Appointment as Independent Outside Directors and Attendance at Board of Directors meetings

Please scroll horizontally to look at table below.

| Name | Supervisory Committee | Independent Director | Reasons for Appointment | 2024 Attendance Status | |

|---|---|---|---|---|---|

| Directors meetings | Nomination and Compensation Committee | ||||

| Akihiko Yanagitani | 〇 | Outside Director Akihiko Yanagitani has acquired plenty of knowledge and experience from a career that includes the management of Sanyo Special Steel Co., Ltd. and as a specially appointed professor at the University of Hyogo and a guest professor at Osaka University studying collaboration between industry and academia in research and other areas. At the same time, he is deemed as posing no conflict of interest with the general shareholders while possessing a high degree of independence from the executive anagement of the Company. We therefore adjudges that he is sufficiently capable of carrying out his role as outside director. |

13/13 100% |

2/2 100% |

|

| Kazuo Hirata | 〇 | Outside Director Kazuo Hirata has acquired plenty of knowledge and experience from a career that includes the management of Nippon Telegraph and Telephone Public Corporation (currently Nippon Telegraph and Telephone Corporation) and New Japan Radio Co., Ltd. (currently Nisshinbo Micro Devices Inc.). Additionally, he is deemed as posing no conflict of interest with the general shareholders while possessing a high degree of independence from the executive management of the Company. We therefore adjudge that he is sufficiently capable of carrying out his role as independent director. |

13/13 100% |

2/2 100% |

|

| Takahiro Tanaka | 〇 | 〇 | Outside Director Takahiro Tanaka has ample experience and knowledge as a lawyer. At the same time, he is deemed as posing no conflict of interest with the general shareholders while possessing a high degree of independence from the Company. We therefore adjudge that he is sufficiently capable of carrying out his role as independent director. |

13/13 100% |

2/2 100% |

| Yasuko Yoshida | 〇 | 〇 | Outside Director Yasuko Yoshida has ample experience and knowledge as a CPA. At the same time, she is deemed as posing no conflict of interest with the general shareholders while possessing a high degree of independence from the Company. We therefore adjudge that she is sufficiently capable of carrying out her role as independent director. |

13/13 100% |

- |

●Criteria for the Independence of Outside Directors

All outside directors fulfilling the criteria of an independent director has been designated by the Company as an independent director. The following is the Company’s criteria for independence.

Criteria for the Independence of Outside Directors

The Company shall judge outside directors or candidate outside directors to be independent unless any of the following items apply.

- The party is a business executor of the ESPEC Group*1, or was a business executor of the ESPEC Group during the past 10 years.

- The party is an entity for which the ESPEC Group is a major business partner*2, or a business executor of said entity.

- The party is a major business partner of the ESPEC Group*3, or a business executor of said major business partner.

- The party receives over 10 million yen per year or other financial compensation, excluding remuneration as a director, from the ESPEC Group as a consultant, accountant, or lawyer (or an employee of a corporation, cooperative and other organization receiving such compensation).

- The party is a person or corporate business executor receiving contributions or subsidies in the amount of over 10 million yen per year from the ESPEC Group during the most recent fiscal year.

- The party is a person who falls under 2 through 5 above during the past 3 years.

- The party is the next of kin*5 of a person who falls under 2 through 6 above (limited to important persons*4)

- *1. “A business executor” refers to an executive director, executive officer or equivalent party or employee.

- *2. “A major business partner” refers to a business partner providing products or services to the ESPEC Group whose transaction amounts exceeded 2% of yearly consolidated net sales in the most recent business year.

- *3. “The party is a major business partner of the ESPEC Group” refers to a business partner refers to a business partner which the ESPEC Group provides products or services to whose transaction amounts exceeded 2% of yearly consolidated net sales in the most recent business year.

- *4. “Important persons” refers to officers or employees in upper management with a rank of department head or higher.

- *5. “Next of kin” refers to a spouse or relative to the second degree.

Director Remuneration

Compensation for directors and Audit & Supervisory Board members for the fiscal year ended March 31, 2025 is as follows.

Please scroll horizontally to look at table below.

| Officer category | Number of recipients | Monetary compensation | Share-based remuneration | Total compensation, etc. | ||||

|---|---|---|---|---|---|---|---|---|

| fixed | performance-linked | subtotal | fixed | performance-linked | subtotal | |||

| people | million yen | million yen | million yen | million yen | million yen | million yen | million yen | |

| Directors (excluding Audit & Supervisory Committee members) | 7 | 150 | 47 | 197 | 15 | 34 | 49 | 247 |

| (Of which, outside directors) | (2) | (14) | (-) | (14) | (-) | (-) | (-) | (14) |

| Directors (Audit & Supervisory Committee members) | 3 | 35 | - | 35 | - | - | - | 35 |

| (Of which, outside directors) | (2) | (14) | (-) | (14) | (-) | (-) | (-) | (14) |

| Total | 10 | 185 | 47 | 232 | 15 | 34 | 49 | 282 |

| (Of which, outside officers) | (4) | (28) | (-) | (28) | (-) | (-) | (-) | (28) |

- Note:

-

- Amounts listed in millions of yen have been rounded down to the nearest million yen.

- The above listed amount of share-based remuneration is the provision for share awards for directors (and other officers) recorded in the fiscal year under review.

- Policy for determining individual compensation for directors

- As a basic policy, the Company ensures that its decisions regarding the compensation of directors are fair and rational. At the same time, the compensation structure provides directors with suitable incentives for raising their motivation to achieve sustainable growth and improve corporate value over the medium to long term for the Company.

- Compensation of directors (excluding outside directors and directors who are Audit & Supervisory Committee members) shall consist of a fixed amount of basic compensation set based on considerations such as rank and tenure, and a performance-linked compensation set based on the Company’s business performance in each fiscal year.

- Outside directors receive only a fixed amount of monetary compensation because of their non-executive status and from the standpoint of ensuring independence.

- The Board of Directors decides the amount of compensation for each director (excluding any director who is an Audit & Supervisory Committee member) following a review by the Nomination and Compensation Committee.

- Directors who are Audit & Supervisory Committee members receive only a fixed amount of monetary compensation because of their non-executive status and from the standpoint of ensuring independence. The Audit & Supervisory Committee decides the amount of compensation for each director who is an Audit & Supervisory Committee member following a review by the Nomination and Compensation Committee

- Policy regarding type and ratios of compensation, etc. for directors

- The types of compensation for directors (excluding outside directors and directors who are Audit & Supervisory Committee members) and the ratios in principle are as follows: monetary compensation (fixed) 60%; monetary compensation (performance linked) 20%; share-based remuneration (fixed) 8%; and share-based compensation (performance-linked) 12%.

- Outside directors and directors who are Audit & Supervisory Committee members receive only a fixed amount of monetary compensation because of their non-executive status and from the standpoint of ensuring independence

- Matters related to financial compensation, etc.

1. Fixed compensation

The fixed compensation component of monetary compensation is determined in accordance with the “Payment Standard for Director Compensation,” which is deliberated by the Nomination and Compensation Committee. The payment is made by paying 1/12 of the fixed compensation component as basic monthly salary on a fixed day each month.2. Performance-linked compensation

The performance-linked component of monetary compensation is determined by the consolidated operating profit margin for each fiscal year, which served as an indicator of the Company's earning capability consistent with its medium-term management plan. The calculation is made by multiplying the basic monthly salary by a payment multiple deliberated by the Nomination and Compensation Committee.

The payment is made by paying 1/12 of the performance-linked component on a fixed day each month starting from July of the following fiscal year. - Matters related to share-based remuneration (non-monetary compensation, etc.)

For share-based remuneration (non-monetary compensation, etc.), the Company has introduced the Board Benefit Trust (BBT), a performance-linked share-based remuneration system, in accordance with the resolution of the 65th Ordinary General Meeting of Shareholders, held on June 22, 2018.

The system is intended to realize a healthy incentive for sustainable growth, as required under the corporate governance code.1. Fixed compensation

The fixed compensation component of share-based remuneration is calculated based on position points determined in accordance with position. The points allotted to each director are exchangeable at the rate of one of Company's common shares per point when payment of the Company's shares, etc. is made.2. Performance-linked compensation

The performance-linked compensation component of share-based remuneration is calculated by multiplying the basic points determined based on position by a performance-linked coefficient.

The performance-linked coefficient is calculated based on a simple average of the achievement rates on consolidated net sales and operating profit targets for each business year (figures announced in the consolidated performance forecast in the Company's consolidated financial results), as indicators of the Company's earning capability consistent with its medium-term management plan.

The time for receiving the share-based remuneration described above in 1. and 2. is upon the retirement of the director, in principle. The total number of allotted points up to that time are converted into a number of shares, which is paid to the director. To secure funds for payment of taxes, 25% of the paid shares are converted into cash at market value at the time of retirement, and paid to the director. - Matters related to the resolution of the general meeting of shareholders regarding compensation, etc. of directors and Audit & Supervisory Committee members

The amounts of monetary compensation for directors of the Company (excluding directors who are Audit & Supervisory Committee members; hereinafter the “Directors”) after the transition to a Company with Audit & Supervisory Committee were resolved at the 69th Ordinary General Meeting of Shareholders, held on June 23, 2022, to be the same maximum amount of compensation as before the transition of up to 300 million yen per year (of which, up to 25 million yen per year is to be allocated for outside directors), and the amount of compensation for directors who are Audit & Supervisory Committee members was resolved to be the same maximum amount as before the transition of up to 80 million yen per year. At the conclusion of that Ordinary General Meeting of Shareholders, the number of Directors was seven (including two outside directors) and the number of directors who are Audit & Supervisory Committee members was three (including two outside directors). Furthermore, in addition to the maximum amount of compensation for Directors mentioned above, the 69th Ordinary General Meeting of Shareholders, held on June 23, 2022, resolved the amount and content related to a performance-linked share-based remuneration system for Directors (excluding outside directors and directors who are Audit & Supervisory Committee members), and based on the Regulations for Delivery of Shares to Officers under the system, the Company has contributed 300 million yen (for a period of four fiscal years). At the conclusion of the 69th Ordinary General Meeting of Shareholders, the number of Directors (excluding outside directors and directors who are Audit & Supervisory Committee members) was five.

-

Matters related to delegations concerning determination of individual compensation, etc. of directors

In the fiscal year under review, the Board of Directors meeting held on May 13, 2022 resolved to delegate the determination of the fixed compensation component of individual monetary compensation of each director to the representative director and chairperson, Masaaki Ishida, in accordance with the determination policy deliberated by the Nomination and Compensation Committee.

The reason for delegating this authority is that the representative director and chairperson, who also serves as the chairperson of the Board of Directors, is deemed to be the most suitable person for evaluating the businesses overseen by each director while taking an overall view of the Company’s performance.

Compliance

Basic Stance

In addition to legal compliance, ESPEC also strives to comply with social norms and engage in company activities that do not run counter to society’s idea of common sense, morals, or ethics. In addition, when there are differences in the enforcement of laws in countries and areas where we conduct business activities, ESPEC enforces the laws that have the highest relevance to society. These views are set forth in Declaration, Corporate Philosophy, and other documents which explain our corporate philosophy (THE ESPEC MIND).

THE ESPEC MIND BOOK

THE ESPEC MIND BOOK

Dissemination and Conveyance of the ESPEC Code of Conduct and Behavior Guidelines

To ensure thorough awareness and understanding of the ESPEC Code of Conduct and Behavior Guidelines within the company, we incorporated it into internal regulations in FY2023. It has been published on our website for internal and external disclosure, and annual training sessions are conducted for all employees of the ESPEC Group.

Establishment of a Compliance Reporting System

ESPEC has adopted Compliance Reporting Rules and created an open compliance reporting system which allows not only employees, but also customers, business partners, and other parties outside of the company to report a wide range of internal and external issues. The system is designed to ensure that users who intend to report an issue do not suffer any unfair treatment.

With the implementation of the system, we aim at preventing unfair practices and other dishonest acts as well as promoting early detection and resolution of issues in order to further strengthen our compliance system.

Training with Regard to Insider Trading

We conduct in-house training for all employees annually to help them acquire fundamental knowledge about insider trading and review the Company’s related internal rules.

Risk Management

Risk Management System

At ESPEC, the process of identifying and assessing company-wide risk is performed and reviewed by the respective department and a sub-committee. The results are then discussed and approved by the Risk Management Committee. The Risk Management Committee works in unison with the Internal Control System Committee and collaborates with the Sustainability Management Headquarters to ensure thorough risk management.

The Risk Management Committee classifies and evaluates risks in four quadrants according to the degree of effects and the countermeasure status. A response policy is decided for each quadrant, and is applied to the activities of the division in charge.

Information security/protection of personal information

In order to ensure information security and allow the effective use of information, we have established the following information management rules and are carrying out complete management: “Basic Information Security Policy,” “Information Security Management Rules,” “Personal Information Protection Rules,” and “Specific Personal Information Management Rules.”

We have acquired the international certification standard ISO 27001 for Information Security Management Systems (ISMS), and we conduct companywide information security training for all employees every year.

●ESPEC Acquires ISO 27001 Information Security Certification

[Overview of Certification Registration]

| Registered Organization | ESPEC CORP. |

|---|---|

| Applicable Standards | JIS Q 27001:2014(ISO/IEC 27001:2013) |

| Certificate of registration No |

JSAI165 |

| Date of Initial Registration | December,16,2019 |

| Accreditation Body | JSA Solutions Co.,Ltd. |

Basic concept and preparation status of the internal control system

Basic policy prescribes that the necessary systems shall be constructed so that decision-making and execution of duties are all conducted appropriately in accordance with laws, the Articles of Incorporation, and company rules, and that ESPEC shall continue to be a company that is trusted by society and its stakeholders. Additionally, we aim to build appropriate internal control systems according to the size and situation of each group company. We have established the Internal Control System Committee, chaired by a director, to evaluate the effectiveness of internal controls, deliberate on fundamental policies regarding internal controls and important matters concerning corporate governance, and report or submit necessary items to the Board of Directors. In April 2024, we partially revised the basic policy for preparation of an internal control system to clarify our commitment to identifying and assessing companywide risks, including those related to materiality, and implementing appropriate countermeasures. Furthermore, in October of the same year, we established the Internal Control Promotion Office to further strengthen internal control functions across consolidated management.

Efforts to Exclude Anti-Social Forces

With respect to the ESPEC Behavior Guidelines, as a basic policy on the exclusion of anti-social forces, ESPEC will resolutely stand up against anti-social forces and groups that pose a threat to social order and safety and obstruct sound economic activities, and will refuse to become involved monetarily or in any other way with any and all illegitimate requests.

In addition to establishing a supervisory division and appointing officers responsible for refusing illegitimate requests, ESPEC is a member of the Osaka Prefecture Corporate Defense Council. As a cooperative effort with the police and other member companies, ESPEC is also striving to collect and exchange relevant information.

Earthquake Countermeasures

ESPEC has adopted Crisis Management Rules as well as Earthquake Countermeasure Procedures, and has made its emergency response known to all employees in order to ensure the continuity of business operations and the safety of all employees in case a massive earthquake. In addition to stocking emergency rations and other disaster stockpile items at all domestic business offices, ESPEC conducts regular disaster drills.

Sustainability

- Message from the President

- Sustainability Management

- Stakeholder Engagement

- Corporate Value Creation Process

- Materiality (important issues)

- Environment

- Promoting Environmental Management

- Measures to Combat Global Warming

- Environmentally Friendly Products and Services

- Measures to Combat Global Warming during Business Activities

- Greenhouse Gas Emissions Report

- Conserving Biodiversity

- Resource Recycling

- Control of Chemical Substances

- Climate-related financial disclosures based on the TCFD Recommendations

- Nature-related financial disclosures based on the TNFD Recommendations

- Environment Data (ESG Data)

- External Recognition for Environmental Initiatives

- Social

- Governance

Fair and Transparent Management - ESG Data

- External Recognition

- ESPEC Programs and SDGs

- ESPEC Foundation for Global Environment Research and Technology

- Sustainability Sitemap